While insurance isn’t a The Know It Guy investment, it’s an important part of sound, savvy personal financial management. Insurance is protection. It protects everything you’ve worked so hard to earn. It protects your spouse in the event of premature death. It sends the kids to college. It holds together a family at a time when money shouldn’t be a concern.

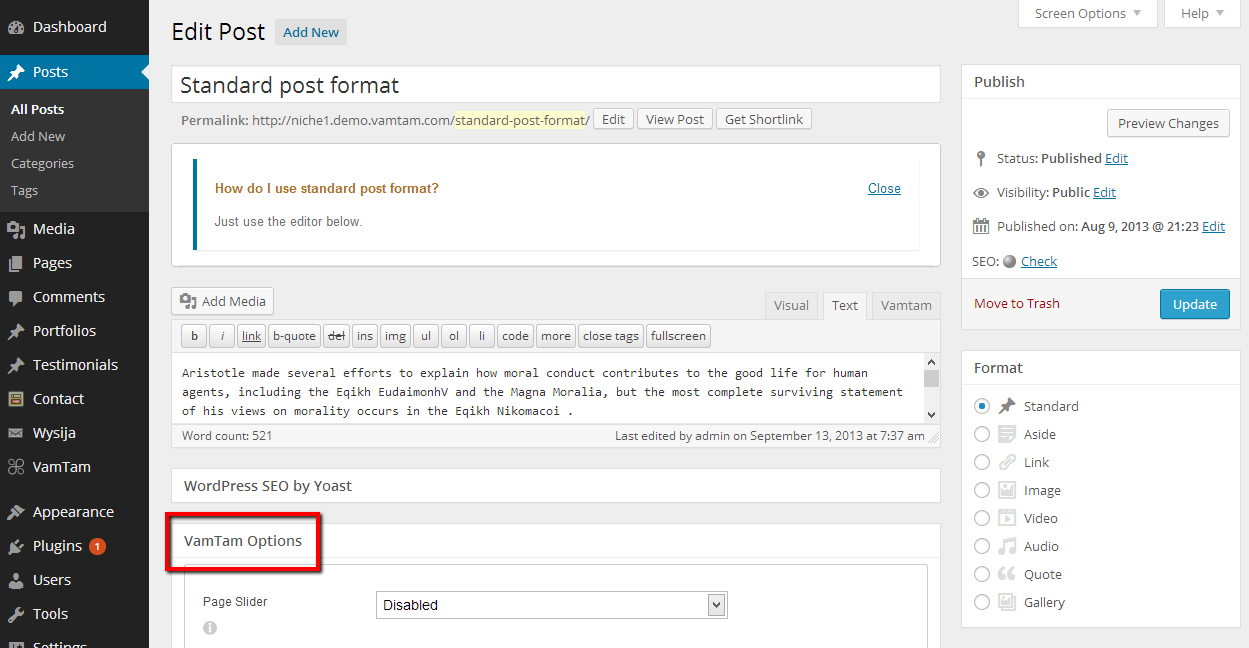

It would help if you had insurance, but shopping for the right coverage to protect your family and assets is like learning a new language. Term life, whole life, universal life, actual cash value, dividends, loans against policy – a maze of insurance products out there, and finding the right coverage for your needs may take some research. Here’s a course on getting the most for the least in life insurance and still having the protection you and your family need.

Types of Life Insurance

There are two basic types of life insurance with numerous variations on a theme.

Term life insurance is the simplest to understand. It’s also the most economical protection you can buy. Term life insurance is paid when the insured (you) pass on within a defined term – a specified length of time your life insurance coverage is in effect.

Term life has various time frames: 5-, ten- and even thirty-year terms are available. It’s simple. The younger you are, the lower the monthly premium cost – the dollar amount you pay for protection each month. Premiums are calculated based on two factors – your age (and general health) and the dollar amount of protection you need. A $100,000 term life insurance policy won’t cost as much as a $500,000 policy because you’re buying less protection.

READ MORE :

- Stay Protected With Coach Sports Insurance

- Mac Games – What Macs Can Offer Gamers

- What Benefits Can You Get From Reading Health Blogs?

- Beautiful Long Eyelashes – What Every Woman Want

- What’s Different About Mobile Learning?

With term life, you keep things simple. The insurance company pays X amount of dollars to the beneficiaries when the insured individual passes on, as long as the policy is in effect. The death occurs during the term of the policy, thus the name term life insurance. Term life policies don’t accumulate value; you can’t borrow against them, and if you choose a short term and your health changes, you could end up paying more for your term life insurance than you would if you buy a long-term policy – one that covers you for the long term.

To determine how much term life you need, add up funeral costs, outstanding personal debt, mortgage debt, the prospect of paying tuition, and other large expenses that would drain family resources. Figure what it would cost your family for a single year. Then multiply by a factor between 5 and 10. Use the lower factor if you don’t have a lot of debt and the higher factor if you carry a couple of mortgages and have three kids to put through school. That’s how much term life you need to protect your family and all their expectations.

The other class of insurance is whole life insurance, also called permanent insurance, universal insurance, variable universal insurance, and other product names. Still, all fall into the general class of coverage called whole life insurance. The first difference between term and real life is that your entire life covers you from the day you buy the policy until you die. Of course, this assumes that you pay your whole life insurance premium each month. There is no term (length of time coverage is in effect) for the whole of the life. Buy it when you’re young, your premiums will be low, and you’ll start building cash value.

That’s the other main difference between term and whole life insurance coverage. The entire life pays dividends. Not a lot, but dividends can be used to lower monthly premiums, or they can be allowed to accumulate earning interest. Once the whole life policy has enough cash value, you can borrow against that cash value to buy a house or cover some tuition bills. The downside to taking loans against the value of a whole life policy is that it lowers the payout to the family in the event of the insured individual’s death.

However, a whole-life policy increases value while protecting your family. The cost of coverage is also higher. Expect to pay more for $500K of entire life versus $500K of term life insurance simply because the insurer pays interest on your monthly premiums. Calculate your coverage needs using the criteria listed above. Don’t think of your whole life as a money-maker. It’s not intended to increase your wealth. That’s a side benefit. An important side benefit, but the primary reason for purchasing whole life, is to protect your family in the event of your premature death.